What Is Tax Planning 7Wealth Explained

Tax planning is the analysis and arrangement of an individual’s or entity’s financial situation or financial plan, to ensure tax efficiency. In other words, the primary purpose of tax planning is to ensure tax compliance while making the most of various tax exemptions, deductions, and benefits available under the laws and regulations.

Tax planning isn’t about shortcuts—it’s about smart and informed financial decisions. It is a strategic exercise to utilize provisions, allowances, and deductions advantageously. These strategies are completely legal and aim to achieve a balance in financial aspirations and tax efficiency.

However, it’s vital to understand the thin line between tax planning and tax evasion. While the former is a legal and recommended approach, the latter is illegal and fraught with consequences. At 7Wealth, our focus is on ensuring that your hard-earned money is utilized and protected in the best legal and ethical manner.

Benefits of Tax Planning:

Optimizing Use of Tax Exemptions and Benefits: Many governments offer certain tax exemptions and benefits to promote specific behaviors, such as investments in pension funds or certain types of businesses. Effective tax planning allows individuals and businesses to utilize these benefits fully.

- Avoidance of Last-minute Decisions: Proactive tax planning allows for strategic decision-making instead of hurried, last-minute decisions that might not be the most beneficial.

- Reduction of Tax Liability: By utilizing deductions, exemptions, and other strategies, one can significantly reduce their overall tax liability.

- Ensuring Compliance: Proper tax planning ensures that you remain compliant with the changing tax laws and avoid penalties associated with non-compliance.

- Fiscal Efficiency: By minimizing tax liability, individuals and entities can better allocate resources to different investments or necessary expenses.

- Future Planning: A good tax plan looks ahead, taking into consideration future income, expenses, and potential tax liabilities.

Components of Tax Planning:

Tax planning usually revolves around three basic components:

Short-term Tax Planning: This involves making plans for the current fiscal year. It’s quick, mostly based on the current tax laws, and focuses on ensuring immediate tax compliance and benefits.

Permissive Tax Planning: This is planned under the provisions of domestic tax laws. It is strictly within the ambit of the provisions of the tax code.

Long-term Tax Planning: This involves making decisions about your financial and investment strategy that will play out over several years, taking into consideration long-term financial goals, future tax rates, and potential changes in tax legislation.

Also A Good Read : Investment Complexity: An In-Depth Look at Portfolio Analysis with 7Wealth

Methods of Tax Planning:

- There are different strategies or methods used in tax planning, including:

- Tax Avoidance: Legally planning and strategizing your finances to avoid paying taxes. It should not be confused with tax evasion, which is illegal.

- Tax Saving: Utilizing the provisions in tax laws that allow for exemptions and deductions to save on taxes.

- Tax Shifting: Shifting the burden of the tax from one period to another or from one entity in a group to another.

- Tax planning is a dynamic process that requires regular review and adjustments due to ever-changing tax laws and personal financial situations. With proper planning, one can reduce their tax liability and ensure that they are taking advantage of every opportunity to save

7Wealth’s Methodical Approach to Tax Planning

Tax planning is not a one-size-fits-all strategy. Recognizing this, our approach at 7Wealth is highly personalized:

- Diagnostic Dive: Our first step is a comprehensive audit of your financial profile, taking into account income sources, expenditures, assets, liabilities, and future financial goals.

- Tailored Strategies: Each strategy we suggest is tailored to the unique needs and goals of the individual or business.

- Long-term Vision: Our focus isn’t just the present tax year. We strategize with an eye on the future, ensuring that you reap benefits in the long term.

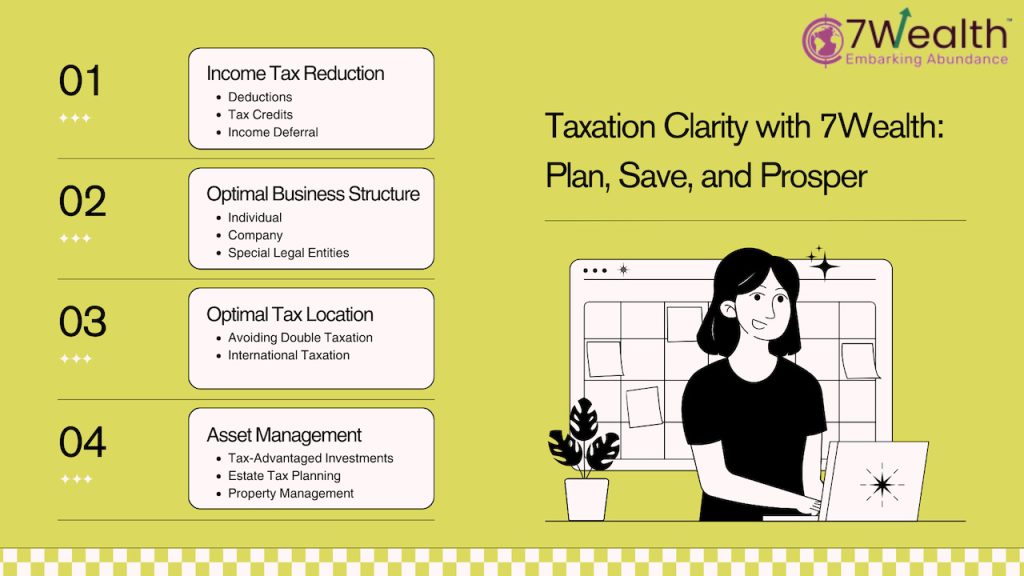

Core Tax Planning Strategies

- Tax-saving Instruments: India boasts a plethora of tax-saving instruments, ranging from the popular Equity Linked Savings Scheme (ELSS) to the Public Provident Fund (PPF). Each instrument has its unique benefits, limitations, and tax implications.

- Deductions: The Income Tax Act, especially Section 80C, provides a multitude of deductions. These range from tuition fees to health insurance premiums. We help you utilize these deductions optimally.

- Asset Allocation: Diversification isn’t just for risk—it can also be a potent tool for tax planning. Different asset classes have varied tax implications.

- Retirement and Tax: Instruments like the National Pension System (NPS) not only secure your retirement but also offer tax benefits.

- Charitable Contributions: Donations, apart from being a noble deed, can also fetch tax deductions under sections like 80G.

Special Tax Considerations

- Real Estate: Owning property brings its set of tax implications—right from tax deductions on home loan interests to understanding the nuances of capital gains tax.

- High-net-worth Individuals: With high wealth comes high responsibility—and increased tax complexities. We offer specialized solutions tailored for HNIs.

- Global Assets: With globalized wealth and assets in foreign countries, understanding and planning for international taxation becomes crucial.

Why 7Wealth Stands Out in Tax Planning

- Deep-rooted Expertise: Our legacy in the finance sector has endowed us with unmatched expertise. Years of navigating the tax maze for countless clients have sharpened our strategies.

- Client-centric Ethos: At 7Wealth, every strategy is curated with the client at its core. We go beyond spreadsheets and numbers to understand your aspirations and fears.

- Staying Updated: The world of taxation is dynamic. As laws and provisions evolve, so does our approach. Continuous learning and training are a staple at 7Wealth.

- Success Stories: We pride ourselves on our proven track record. Our clientele, ranging from professionals to businesses, stands testimony to our excellence.

FAQs on Tax Planning

What is the main objective of tax planning?

The primary objective of tax planning is to ensure tax efficiency. Through tax planning, all elements of the financial plan work together in the most tax-efficient manner possible.

How is tax planning different from tax evasion?

Tax planning is a legal and proactive approach to minimizing one’s tax liability through the best use of all available allowances, deductions, exclusions, exemptions, etc., to reduce income and/or capital gains. Tax evasion, on the other hand, is an illegal practice where a person, organization, or corporation intentionally avoids paying their true tax liability.

Why should I start tax planning early in the financial year?

Starting early provides you with the advantage of better planning and making investments in a staggered manner. It avoids the last-minute rush, which often leads to hasty decisions. Moreover, many tax-saving investments also require a certain holding period for their benefits to fully materialize.

Are all tax planning methods beneficial for everyone?

Not necessarily. The effectiveness of a tax planning method depends on an individual’s financial situation, goals, risk appetite, and the prevailing tax laws. It’s always advisable to consult with a tax or financial advisor to determine the best strategy for one’s circumstances.

What happens if I don’t use my tax-saving deductions fully in a particular year?

Unused deductions usually cannot be carried over to the next year. If you don’t utilize them fully in the given fiscal year, you’ll lose out on those specific tax benefits for that year.

Is tax planning only for the wealthy?

No, tax planning can benefit everyone – whether you’re just starting out, in the middle of your career, or nearing retirement. Different strategies cater to different income levels and financial goals. Everyone has the opportunity to reduce their tax liability through effective planning.